“Competition is for losers…so don’t focus on competitors”

People love to share this advice – and why wouldn’t they? It’s cute; it’s tweetable; and it calms the anxiety center of your lizard brain every time a customer asks you about a competitor.

Yet, it’s also the dumbest piece of business advice I’ve ever heard.

And that’s saying a lot.

Proponents of “don’t focus on competitors” have two core arguments – a dumb one and a smart one (that’s still wrong).

The dumb argument is that, “your customer is all that matters, so you should focus on them, not your competitors.” This argument’s well-intentioned, but outdated. Two decades ago your customers weren’t really aware of your competitors and finding products for their problems, let alone multiple competing products, was difficult. Ads were new (and definitely not targeted) and we didn’t write content, so information was siloed.

Put more simply – your customer used to be ignorant of what was in the market and had few ways to get educated, so you could take advantage of them (intentionally or unintentionally).

That’s all changed though.

Today customers can easily search for dozens of solutions to problems and we bombard them with targeted ads. So now your customers are either aware of your competitors or can easily become aware of them. In fact, we studied 11.2k decision markers for household and corporate budgets and found they look at an average of 3.2 products before making a purchase. That’s almost triple what it was a little over a decade ago. Therefore, if your customers care (or will care) about your competitors, you need to care about them, too.

That leaves us with the smart argument for “don’t focus on competitors”. I call it the “Peter Thiel” argument, because it was popularized by the famous PayPal founder.

Thiel essentially argues that winning entrepreneurs build 10x better products in new markets where they can establish a monopoly. Their monopoly gives them the freedom to ignore competitors. The rest of us are losers.

Like most smarty pants theories, it’s 100% right. If you can build a 10x better product in a new market to establish a monopoly, you should stop reading and go do that. Build the next Google. Go. Yet, that’s probably one of you – not 1 out of 100 of you – one of you.

For the rest of us, Thiel’s advice is behind the times, because building a 10x better product isn’t possible anymore. I know that’s triggering to some of you and your Elon Musk complex, so hear me out:

The barriers to building stuff – software, consumer products, media, etc – no longer exist. That fancy app feature can be ripped off in months, not years. Those special DTC ingredients; the factory will sell them to anyone. So if you don’t have patentable, hard science breakthroughs or regulatory protection, you won’t have a 10x better product (or at least one that’s 10x for long).

Competition is now permanent. If you Ignore your competitors, you’ll fail to defend your flank from attacks. You’ll also miss out on one of the best channels for siphoning revenue from them to you. Don’t believe me? You know your boy brings the data. In research looking at 3.2k companies, those who had competitive programs had:

- 23.7% lower customer acquisition costs

- 18.9% higher customer lifetime value

- 15.4% higher customer satisfaction

I like those gains. I’m assuming you will, too. They’re also why I designed a comprehensive competitive intelligence program that I used to fuel my company ProfitWell to an exit of over $200M. It gave us extreme leverage, which we needed since we were bootstrapped. It also tanked several of our competitors’ funding rounds.

The program combines playbooks from companies at the cutting edge of competitive intelligence programs with the training I received as an intelligence analyst fellow at the NSA while hunting bad guys and gals.

So here’s what we’re going to do:

First, I’m going to give you the proper framework of how to think about competitors in your space. The framework automatically uses data to determine who your competitors are, how much you should care about them, and what you should do with each.

Next, I’m going to give you everything you need – email copy, survey copy, VA instructions, calculators, templates – literally everything in order to create your version of the framework and then monitor these competitors for and hour per month (or quarter).

Finally, I’m going to give you the thirteen playbooks I use (and have seen others use) to attack and defend themselves from competitors.

This’ll be the last guide you’ll ever need for competitive intelligence.

You pumped?

Oh and one more thing – it’s free.

Let’s go.

What’s the Goal of a Competitive Intelligence Program?

So what in God’s name is a competitive intelligence program and what does it do?

Good question.

To some of you, competitive intelligence (and research in general) feels like a waste of time. You do a bunch of work, get some data, and then only 5% of it’s immediately actionable, so you decry the effort as too costly.

You’re also probably scared to do research, because you deal with a lot of Darrens and Karens at work. Karen asks stuff like, “is 104 responses statistically significant?” (without knowing that’s the wrong question). Darren likes to go on tirades about “Steve jobs using just his instincts to innovate” (even though Apple spends hundreds of millions on research every year). If your research effort doesn’t have an immediate payoff, then why do it in the first place?

Here’s the issue: you (and Karen/Darren) are thinking about research completely incorrectly.

Immediate, precise action directly from research isn’t the goal. As my mentor at NSA once told me, “intelligence is upstream of action.” Your goal with research is to build judgment. With every morsel of intelligence you’re training your instincts, so when you do take action, you make infinitely better choices and you make those choices quicker.

When you find out a terrorist is about to attack, you don’t want to spend precious hours trying to figure out how they think and what they’ve done in the past. You just want to know. You want enough judgement to respond swiftly and in the right manner.

Business is extraordinary similar (albeit less deadly thankfully). Your entire mission as an operator is to understand your customer and the market that seeks them as a customer better than anyone else. You cannot build that judgement quickly without research, especially on your competitors.

When you don’t, competitors sneak up and overtake you. MySpace dominated the social media market until Facebook – the company they thought “was just some college kid’s toy” – used the college niche to destroy them. Blockbuster knew exactly how quickly Netflix was growing and had all the money in the world to build a competing product, but didn’t counter attack until it was too late. At ProfitWell, we attacked our incumbent competitors for years without any of them putting up a defense.

None of these products were 10x better. None of them had secret technology. The incumbents had so much more money than the competitors, and could have maintained their dominance. Yet, hubris and a lack of understanding of their market cost them everything.

But wait – you’re not a giant company (yet) facing extinction, so what’s this got to do with you?

Competitive intelligence is essential to your existence at every stage. Your customers consider your competitors and and use them, so you need to care about them.

When you properly implement a Competitive Intelligence Program you know know who to attack and who’s attacks to defend. You end up learning more about your market and customer than anyone else. That knowledge leads to more revenue, lower costs, and infinitely better products.

You may nod your head at all of the above and still feel an emotional drag. You’re an executive. Caring about what a competitor’s doing feels weird, even if it logically makes sense. That feeling’s hubris though. It’s the same feeling that lead those incumbents to get destroyed by lesser competitors. We all share this hubris. It stems from a level of undeserved confidence, because we needed a coping mechanism to overcome the doubt and fear of failure.

It’s understandable.

Yet, do not be arrogant enough to think you will know better than your market. Be humble enough to always assume you can learn more, and your greatest avenue to that is customer and competitive research.

So all that being said – what the actual heck is a competitor intelligence program?

I’ll stop trying to get your buy-in and we’ll transition to giving you the meat.

A competitive intelligence program (even the government’s) has three parts:

- Target Identification: which competitors should you care about and how much should you care about them.

- Intelligence Monitoring and Extraction: monitor the proper competitors with automatic intelligence collection and targeted extraction campaigns.

- Operationalize Intelligence with Playbooks: use intelligence to attack and defend the right competitors in the right manner at the right time.

When done right, all three of these parts are automated and sourcing you competitive research consistently. You sit back and consumer that research to build your judgment. You see what appears to be working and what trends are shifting. With that judgment you make better decisions and implement playbooks that drive to your ultimate goal – more customers and more revenue.

I’m going to give you everything you need to run your whole program (for free) in as little as 1-2 hours of your time per month. Before we get to that though, I need to teach you the right way to think about your competitors in your market’s competitive landscape. You likely haven’t seen it before.

How to Think About Competitors

When you pay a business professor $150k to teach you about competitive strategy in an MBA program, they typically start with some variation of, “there are four types of competitors” – direct, indirect, potential, and substitutes.

They’ll then tell you the best way to determine your competitors is to think about each category of competitor and use Google and social media to come up with companies and products to put in each. Your job is to then come up with a “strategy” for each set of competitors.

While well intentioned and useful on a banal level this is closer to business masturbation than high output operations.

It’s the type of approach that creates a pretty presentation that receives lots of “great work” DMs and slack emojis before being put out to the cloud storage sea like all those other “strategy” presentations.

But why does it stink so much?

The reason’s important.

The above competitor categories focus on your view of the market. Here’s the problem though- your view doesn’t matter. It’s riddled with bias. If I ask you or ten of your executive friends who their top five competitors are, I bet most of my net worth the answers will eerily overlap with the five companies most mentioned in board meetings, team all hands, and sales calls.

This is natural, and it’s not that these companies aren’t competitors. Yet, we tend to raise the importance of a competitor to the level of our anxiety, not reality. Instead, we need a competitor framework that centers on the customer view of the market.

Who are your competitors?

Whichever companies your customers think about or can easily find when they think of needing your product.

How much should you care about each competitor?

To the level of their resources and marketshare relative to you and the rest of the market.

It doesn’t matter if they’re direct, indirect, or whatever; what matters is how much your customer cares about them. Given that principle, the framework you should use to properly map your customers is the Market Command Matrix. It maps your competitors on the only axes that truly matter – Market Mindshare (eg. how aware are customers of the competitor) and Resource Strength (eg. how much money is the competitor dedicating to the market).

Let’s walk through these axes in a bit more detail.

Market Mindshare

Market Mindshare is the level of awareness each competitor has in the market proportional to one another. That company customers instantly think of when thinking about a product (eg. “Google” and the search industry) – high mindshare. The hot new startup with $500M in funding, but no one has ever heard of – low mindshare.

Most importantly we’re mapping each competitor’s Market Mindshare by collecting data directly from customers (more on how to do this automatically later). They’re the ultimate arbiter of which competitors are important. By measuring their view we’ll know who to attack to siphon the most revenue and who to ignore, because they’re not worth our time.

Resource Strength

Apart from mindshare, we also need to understand each competitor’s Resource Strength – how many resources they’re dedicating to winning the market. That company who’s 10x bigger than you and has raised more money than God – high resource strength. The indie hacker who built a product over the weekend – low resource strength.

Resource Strength is a proxy of how much a competitor actually cares about the market. That level of care translates to who you’ll have to keep your eye on the most, because they can point those resources at you anytime they wish or are more likely to respond to one of your attacks. All of these folks we’ll monitor automatically with the tools we built out for you below. You may also need the defensive playbooks we’ll walk through, too.

Using Your Market Command Matrix

As I’ve been teasing a bit already, when you combine these two variables something powerful happens. You get an exceptionally pragmatic map of the market that guides you on what to do exactly with each competitor.

That competitor with high Market Mindshare and no resources dedicated to your market – go all out attacking them by trying to partner, because you’ll harvest a lot of customers quickly.

That competitor who complains about you a lot on social media, but no one uses – stop wasting your team’s time talking about his posts.

As you’re building, you only have so many resources. You need to spend them wisely. The magic of the Market Command Matrix is each section clearly shows you how to treat the competitors within them.

Competitors to All Out Attack

Competitors with high Market Mindshare and Resource Strength are high leverage for you, because these competitors will attack you and have lots of customers for you to steal, so you need to focus on them.

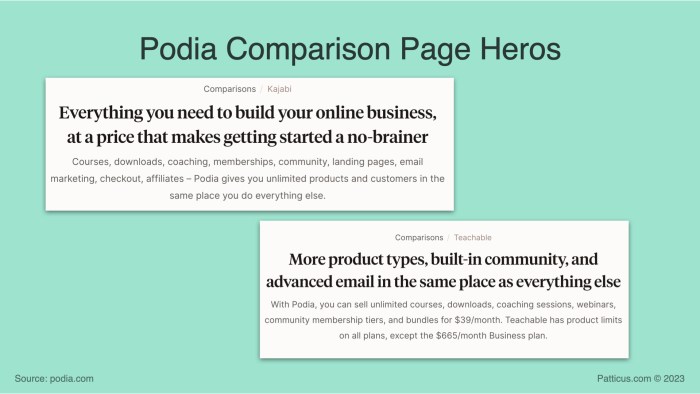

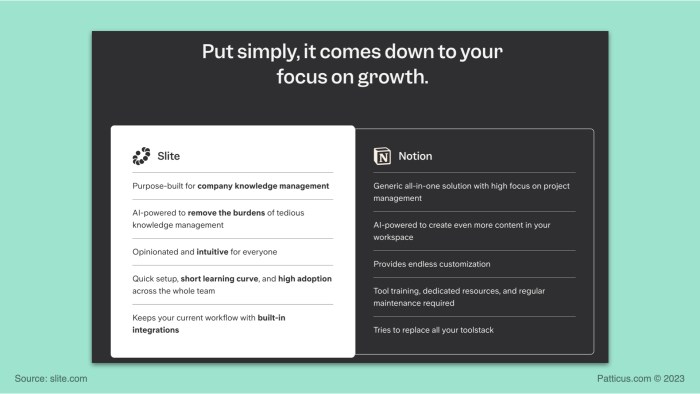

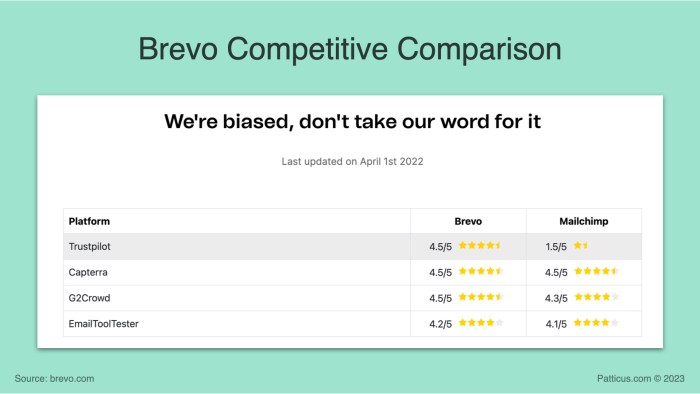

We’ll go through all the playbooks to use for these competitors (all for free below), but the overall gist is each of them will need comparison pages, sales battlecards, marketing campaigns, and partnership resources. They’re also the folks you’ll run your Wedge Strategy on.

Competitors to Just Monitor

These competitors have a good amount of resources dedicated to your space, but not much mindshare. They typically come in two ironically opposing flavors – either companies that are slowly losing in the market (incumbents) or new, well funded companies that are gaining Market MindShare.

Since they don’t have as much market share, but still could pose a threat with their resources, we want to monitor them until they’re worth our time and resources (eg. cross into the “All Out Attack” quadrant).

Competitors to Harvest

Competitors here are typically broad solutions that happen to be used to solve the problem your product solves. For instance, people use Microsoft Excel or Google Sheets for property management, but presumably they’d be so much happier with a software product purpose built for property management like Appfolio or Buildium. Microsoft and Google also don’t care about the property management market specifically, because their products are purposefully broad.

This mismatch is an enormous opportunity for you to harvest customers from these competitors, because presumably your product is much better for solving their problems than the “good enough”, broad solution. All playbooks (which we’ll share) should focus on creating doubt in the mind of the customer and making it easy to onboard to your solution.

Competitors to Ignore

Few people seem to use or have heard of these competitors and they don’t have a ton of resources dedicated to your market. They’re not worth your time, so ignore them. If that happens to change over time, you’ll be alerted through the monitoring playbooks we’ll go through in a bit.

Like all good frameworks, the Market Command Matrix focuses on action. We’re not just labeling who could be a competitor we should worry about. We’re identifying who is a competitor we should worry about and which playbooks we should use on them (which we’ll go through in a bit).

You’re probably thinking, “sure, but this seems like a lot of work and where’s the action to make me money?”

I got you.

We’re going to walk through how to create your own Market Command Matrix automatically. It’s the first step of building your competitive intelligence program. We’ll then give you all the playbooks to take action for each competitor in each quadrants.

Let’s roll.

The High Output Competitive Intelligence Program

The ultimate aim of any intelligence program is to make gains of any kind from your competitor while protecting yourself from any competitor attacks. For the US Intelligence community, those attacks and defenses optimize for maximizing security of all kinds. Whether it’s working to identify a terrorist cell and dismantling it before an attack even occurs or discovering the strengths and weaknesses of a trading partner before a negotiation, intelligence is the key.

For your business, those attacks and defenses optimize for revenue. Thankfully this makes your competitive intelligence program infinitely easier than that of a nation.

I had the honor of learning how the greatest intelligence community in the world works when I hunted targets for the NSA. I used those same frameworks and tactics to build a high growth company in an incredibly competitive space.

I’m not able to tell you specifically how the inside of the IC works (or I’d have to kill you ;)), but the Competitive Intelligence Program we built out for you takes a lot from my experiences. We then combined those lessons with 500+ hours of research on what the best companies in the world are doing when it comes to competitive strategy.

We’re about to walk through the whole program. It’s got three parts, and each part has a lot of free tools we built for you. Our goal is to give you everything you need to run your entire competitive intelligence program for 1-2 hours per month (or quarter). Seriously.

Let me say that differently – you’re about to have the keys to an engine that will boost revenue, control costs, and give you the ability to understand your market better than anyone else – for 1-2 hours of your time per month (or quarter). It’s also free.

To achieve this we wrote a ton of instructions that you’ll hand off to an assistant or team member and automated a lot of the steps. Some of that content isn’t exactly exciting and may slip into feeling a bit like an “instruction manual.” To curb that feeling, we hid a lot of details behind toggles or pushed them to your shiny new Competitor Command Center (more on what that is in a second). Basically, we’re going to make you a bunch of money and did most of the work for you, so don’t please complain if some of the details we built for you and your team aren’t riveting.

Cool?

Cool.

Let’s keep moving.

Any Competitor Intelligence Program (even the US government’s) has three main parts:

- Reconnaissance – Identifying your competitors: Who exactly are your competitors? Here we’ll answer that questions by automatically creating your market’s Market Command Matrix. From there you’ll know exactly who to worry about, spend time on, and ignore.

- Monitoring and Extracting Intel: Once we know who we should be tracking, we need a system for collecting research and intelligence on those competitors. Monitoring these competitors builds your judgment and market instincts to properly deploy the playbooks for siphoning revenue from your competitors.

- Intelligence Operations – Playbooks to Attack and Defend: Knowing who to track and monitoring them is just the first piece of the puzzle. Now we need to deploy our revenue playbooks at the right time. We’ll walk through thirteen of them.

To make running each part of your Competitive Intelligence Program easy we built out three core tools for you. They’re all free, and contain all of the instructions, calculators, copy, etc. we put together – basically anything you’ll need.

As we walk through each part of your competitor program, we’ll reference these and go deeper on their relevant parts, but here’s a quick overview of each:

Competitor Command Center

The Competitor Command Center is the hub for all your competitor intelligence – all the research, data, findings, etc on each of your competitors. It also contains every automation and instruction that your assistant or team member will use.

We built it out to make everyone’s lives as easy as possible. The only work you will personally need to do is to fill out the “Settings and Instructions” tab. It’ll take 20-30 minutes and then the sheet automatically adjusts all the instructions for your assistant or team member. They’ll then go off and do the rest of the work. We’ll go through more details on their pieces in a bit.

Given this is your hub for the competitor program, we recommend not sharing this with a wider audience. Keep it to you, the team using the finer details, and the assistant or team member doing the legwork.

Market Intelligence Stakeholder Deck

Once your Competitor Command Center starts spitting out awesome insights, we need your executive team, board, and company as a whole to use them beyond the competitive playbooks we’ll walk through below. We also want to wow them with your work, so we created a Market Intelligence Stakeholder Deck for you.

This deck provides an overview of the competitor and market intelligence you’ll collect (more on that in a beat). It automatically updates every time your assistant or team member refreshes the data in the Competitor Command Center. You can then send the deck with a note to these stakeholder groups to keep them in the know. We’ve drafted a message for you to use and more context below.

Your Guide to Competitor Intelligence

Your assistant or team member may need more context as they evolve your Competitor Intelligence Program. Your executive team may want more context on how to use the intelligence you’re gathering. To help, this guide you’re reading right now is your third resource. It’ll be updated over time with new playbooks and answers to any common questions that come up.

I did say we’d make your life easy, right? 🙂

Now it’s time to jump fully in to the first part of your Competitor Intelligence Program – identifying who the heck are your actual competitors.

Part 1: Reconnaissance – Identifying your competitors

When Rear Admiral Roscoe H. Hillenkoetter took over as CIA’s first ever director, he had a similar problem as you do right now – who are the “enemies” on your initial list of targets? You actually have a harder job than Roscoe, because at least he could choose from a finite number of nations on a map. Your competitors come from many different directions.

To warm up this cold start problem though, we can learn a lot from his initial approach. He began his efforts to map his competition with a “global sweep” where he cast a wide, indiscriminate net across foreign media, diplomatic communications, and early spy briefs. We’re going to do something similar within our market using the best army of spies a business can get – your customers and prospects. They’re the ones actually looking for a solution, from you or your competitor, so they’re the best folks to understand the market.

We’re going to use them to build out our Market Command Matrix.

How?

Well, if your customers are the perfect spies to understand your competitors, because they’re the ones using them and their view is the only one we care about, why don’t we just ask them?

That’s exactly what we’re going to do through a survey.

Wait.

Don’t leave.

I know what you’re thinking – “a survey? People hate surveys! They suck so much.”

We only hate surveys, because we suck at sending surveys, so we receive a lot of crappy, poorly thought out surveys that waste our time. Surveys are actually a phenomenal tool to get credible data when done properly, because they go right to the source (your customer) and extract intelligence when you use the right questions. Thankfully we sent over ten million of them via our pricing product, so we learned a ton on how to do them right.

We made this so easy for you. We built out the survey and email copy you’ll send, as well as a spreadsheet calculator for the survey results. You just plop them in and your Market Command Matrix automatically gets built. It’s not magic, but it’s pretty close. It’ll even automatically put your matrix right into that pretty slide deck we built for you, so you can confidently present your research to your team.

All the instructions are below (and in your Competitor Command Center), so putting this together should be a piece of cake. Yet if for some reason, you still don’t want to do the work, complete Step A below and skip to Part 2: Monitoring and Extracting Intel of this guide. You’ll miss out on a lot of insight and your confidence in running your competitive program will be lower. But, I don’t want perfection to be the enemy of progress. At the very least, read through the steps to see how easy it is – cool? Cool.

Let’s walk through the three steps to conduct your global sweep and then talk through how to interpret your built out Market Command Matrix.

Conducting Your Global Sweep

To conduct your global sweep you’re going to: A. input initial market information in your Competitor Command Center, B. send a survey using the copy and email we built for you, and C. paste the results into a tab in the Competitor Command Center, which will automatically calculate and produce your Market Command Matrix.

Most of the work is done completely for you. Step A will take you only ~ 30 minutes. Your assistant or team member will then handle Steps B and C using the instructions and tools we built out for them. There workload should only take a couple of hours max since we designed everything to be as easy as possible.

At scale I run these global sweeps on a quarterly basis (especially since they’re so automated). Markets tend to shift this quickly. If you’re just starting off though, I’d run your global sweep once every six months and then ramp up from there. A few of you only need to run once per year, but we’ll talk about if you’re that person when we chat through interpreting your Market Command Matrix.

Once you’ve completely each step your matrix will tell you exactly how your market’s shaped and seen from your customer’s perspective. We’ll then use that knowledge and other research to run playbooks to increase our revenue flow from those competitors.

Here’s a deeper dive on each step to running your global sweep:

Step A: Initial Market Information

The core of your global sweep involves sending a survey through an email. We could tell you which questions to use and how to write the perfect email like most guides. Yet, we’ve done this hundreds of times at this point, so why don’t we just do it for you?

All you need to do is fill out the “Settings and Instructions” tab in your Competitor Command Center. There we ask you some questions about your category, competitors, and preferences when it comes to conducting competitive research.

We then do some magic, and boom – you have your survey and questions.

There’s more though.

When you fill out this tab, we also take your inputs and create all the instructions to run the next part of the Competitive Intelligence Program – research and monitoring. With less than 30 minutes, nearly all the work you’ll need to do to setup not only your global sweep, but your entire program is done.

Pretty cool, right?

You sit back and use the data. We’ll do the rest.

Deeper Dive: Two “Settings and Instructions” inputs that are extra important

All of the inputs are crucial, but two in particular will setup most of the other instructions for doing your global sweep:

- Initial List of Competitors: Here you’re inputting up to 10 competitors that you’re thinking about (I recommend five max unless you’re a public company). Why are we doing this when I just wrote pages of why you’re biased? Well, you know something about your space and when we go talk to customers and prospects we’re going to ask them aided and unaided questions. For the aided ones, we need them to respond to a list.

- Your company category: This is a really critical piece of information, because your respondents are going to be responding to a question like, “when you think of YOUR CATEGORY, what’s the first product you think of?” I’ve included some examples in these instructions, but use whatever you’re currently using when answering “what’s your company do?”.

Step B: Conducting your global sweep

Once you’ve entered your inputs in the Setting and Instruction tab of the Competitor Command Center, we actually have to run the global sweep. Let’s walk through how we’re actually going to do that.

Remember we’re extracting intelligence from our perfect market spies – the market’s customers. They’re the ones who actually buy the products you and your competitors build. We just need to get into their heads in a way that limits bias. When we do, they’ll open up about which competitors they know, who they prefer and why, and they’ll even tell us exactly how to get them to convert from a competitor to you.

Sounds great, but also hard, right?

Don’t worry. There’s a secret.

At ProfitWell we sent millions of surveys that let us and our clients read customers’ minds. In the US Intelligence community thousands of people give valuable intelligence every day – even when they know they shouldn’t. In both contexts it all comes down to one thing – asking the right person the right question.

We already have the right person – your target customers. We go into more detail in the below toggle on precisely which target customers you should send your survey, but which questions are the right ones?

Deeper Dive: Who to target for your global sweep?

This is the single hardest piece of the entire Competitor Intelligence Program. Everything else is smooth sailing, but this one part we can’t do completely for you. I guess we could build an entire tool and give it away for free, but that’d be a company in and of itself, and I’ve got healthcare to go solve.

So what’s the hard part?

You need to put together a list of respondents to send your survey to, which will take effort. It doesn’t need to take a lot of effort and every time you send this survey it’ll get easier, because you’ll use the same list. Yet, there’s still some lifting here. I promise it’s worth it and we’ve worked to make it as easy as possible.

Here’s where I pull my email lists from to send competitive surveys – in order of easiest to hardest:

- Customers and prospects in your database: These folks are pretty easy for you to use, but you’re going to get bias in your dataset, because these folks are presumably already aware of you (prospects, less so). Yet, they’re better than nothing. At the very least, I would send your survey anonymously (more on this below) to limit bias.

- Market Panelists: Entire companies exist to get you in front of your target customer base to ask them questions and do research. Depending on your product, the cost will range from pennies per response (consumer products) to hundreds of dollars per response (Fortune 500 CIOs). The advantage to using these companies is you’re anonymous (so low bias results) and since you’re paying, you can add more questions you’re curious about, because you get more time with a respondent (15-60 minutes typically).

- Prospects outside your database: One clever way to build an email list for sending your survey is to use tools like BuiltWith, Zoominfo, Clearbit, et al. Here you pull a list of companies in your target market and then find the email addresses of the specific roles you target inside each company. This definitely isn’t compliant and I likely should’ve never done this, so run this playbook at your own risk. Today I’d just spend the money on market panelists, because it’s quicker and above board.

- Competitor Customers: Your competitors talk about their customers all the time, so another sourcing method is to pull all the logos from their website, case study pages, review sites, and social media. You then pull the emails of your target roles at these companies and add them to your research queue. Big note – Pulling these competitor logos is a part of the monitoring section, meaning your assistant or team member will do this work for you, so it may make sense to wait until the second or third time you send the survey to include them.

- Runnings Ads: If you don’t want to pay for market panelists or send cold email, then ads is another option. It takes longer, but you can do most of the targeting based on pulling these database lists and then driving people to the survey.

For the questions we need to get into how people think. We’re a highly suggestible species. It’s biological and stems from the fact we mostly learn via metaphor. When your ancestors saw someone die after eating certain berries, they survived by not eating those berries. That’s great for not dying, but terrible for trying to ask you a question that doesn’t immediately make you think of an answer (which I suppose is a worthy tradeoff).

For instance, if I ask you, “Is Coke the best soda?”, you’re automatically going to react in your head with “yes” or “no.” Your second thought will be something along the lines of, “which soda is better than Coke?”. My question, while well intentioned, has anchored your entire thought process around Coke, which makes it a crappy question for determining the best soda.

Here’s a better question: “what’s the best soda?” It’s a harder question for humans to answer, but that’s by design. You have to put in the work to think about soda, what makes the best soda, and then which sodas would fit that paradigm. By giving you space to formulate your answer we limit bias considerably, because we’re asking in an open ended manner.

In the market research world these open ended queries are called “unaided” questions. Questions where you give someone a few choices to choose from or something to react to are known as “aided” ones. We’ll use both in our global sweep, but the unaided question will carry most of the weight of our Market Mindshare score for our Market Command Matrix.

Check out the below toggle for the actual questions, but we also need to address one more piece – how do we position the survey to these customers?

Deeper Dive: Which questions will we use to extract intelligence from your target customers?

Approaching someone you want to get collect on requires careful consideration of what biases someone. If I ask you, “what do you think of Coke?”, you’re going to think about Coke and then Pepsi. Yet, if I ask you “what’s your favorite carbonated beverage?”, you have to come up with the answer.

These open ended questions are what’s called “unaided” questions. They’re a little harder for humans to answer than a multiple choice question, but giving us an answer without any prompting limits bias considerably.

Because of this our core question for mapping competitor Market Mindshare is:

- When you think of YOUR CATEGORY, what’s the first product that comes to mind?

The beauty of this question is it’s open ended nature will receive a wide variety of answers. Many will surprise you. Some will make you think the data’s wrong, because it’s easier to admit that then maybe you’re not as big or you’re close to a competitor you don’t like than you thought.

Remember we don’t care about what we think. We’re not seeking the answer you want. We’re seeking the truth. I’ve been in a couple dozen board rooms talking through Market Mindshare studies where executive teams are shocked by the results. The best ones go all-in on using the data to improve their spot in the market. The worst deny any validity, because it makes them feel insecure. Be the former.

We’ll also ask some “aided” questions to measure recognizability and usage. These questions give them different competitor names to choose from and their goal is to go deeper on the subset of competitors you’re currently thinking about:

- Which of the following YOUR CATEGORY companies are you familiar with? (multi-select from list)

- When you think of YOUR CATEGORY, what do you currently use? (select from list)

- How likely is it that you would recommend COMPANY CURRENTLY USE to a friend or colleague? (0 through 9)

- When you think of COMPANY CURRENTLY USE, what’s the most valuable? The least valuable? (List of core features).

That’s it. Those are all the questions. I promised it wouldn’t be too complicated.

With just five questions, we glean an enormous amount of insight. We’re able to build out our Market Command Matrix, as well as get signals on usage, recognizability, satifafaction, and even how competitors compare to one another. We’ll talk more on how to combine this data with other market data in a bit, as well as how to actually use the data in our competitive playbooks.

Just keep in mind – all you have to do is send the survey through an email (both of which were create for you). You’re probably wondering though – who’s going to receive this thing?

If we send a survey from your brand, obviously there’ll be some bias. If we tell a survey respondent we’re collecting this data to chart our path to market domination, there’ll obviously be bias, too. We’ll limit this bias by sending the survey in the right context.

Ideally this means we send the survey anonymously. When anonymous, we can control the context and messaging in a manner that gets us the best responses. They won’t know it’s us and we’ll make our email copy generic (eg. “we’re doing research on the marketing space”).

Two ways to achieve anonymity – 1. use market panelists (more on those in the “who to target…” deeper dive above), or 2. send from a domain you buy like marketingresearch.com (or something to do with your space). For the latter, you can still maintain compliance by listing your legal name in the footers, terms, etc, but most people won’t look there (which is what you want).

One other advantage to anonymity – you don’t tip off competitors. You may think I’m paranoid, but I don’t want to cede my competitor an inch in general. When it comes to this survey I also don’t want to give them fuel for marketing.

While building ProfitWell, we had a couple of competitors that were very vocal on social media. While some of their criticisms were valid, the way they engaged with valid or invalid criticism was often less than charitable. A survey like this would be good fodder for them, and I didn’t want to risk a public discussion.

When in doubt, use your best judgement and do what best aligns with your values. Either way, I’ve put a deeper dive on the exact copy for the email, as well as survey send best practices in the below toggle.

Deeper Dive: Global sweep email copy and survey send best practices

For getting the best response rates use plain text emails. After sending millions of surveys, we’ve found plain text gets roughly 30% higher response rates.

For your copy, we already wrote the email (and follow up) for you in this tab. The copy’s goal is to be intriguing enough to entice someone to take the survey without biasing them. You’ll notice a couple of ego traps to accomplish that aim. A version of this email’s been battle tested across a lot of survey sends, but feel free to edit as you see fit.

In terms of other quick hacks for sending survey emails:

- Send it early morning based on their time zone

- Send a bump 3 days after the initial send for folks who didn’t open (copy in the tab)

- Don’t use a raffle or prize to incentivize responses. It’s rarely effective unless you’re paying each individual respondent.

- Schedule a thank you message that gets shipped when someone completes the survey

From here assuming you filled out your “Settings and Instructions” tab your team member or assistant will bring you final copy and a survey link to conduct your global sweep. You’ll need to give them guidance on which target customers you’d like to target and any logistics for making that happen.

This is the hardest part of the whole Competitor Intelligence Program. That’s a good thing, because it’s really not that hard. We made it incredibly easy by doing most of the thinking and work for you. That’s a bad thing though, because you will have to put some effort in to get the results.

To help – remember what you’re getting with conducting your global sweep. You’ll have actual data to support where you and your competitors are in the market. We’ll then use that data to run our competitive playbooks that siphon revenue from your competitors to you. As an added bonus for conducting your global sweep and sending your survey, we’ll give you a little reward in Step C next. That’s where the real magic happens.

Step C: Building your Market Command Matrix automatically

Since you did the hardest part of the whole project, we thought it only fitting to reward you with some magical results. We could have told you how to do the math and let you wallow in spreadsheet purgatory, but that wouldn’t be very nice.

Instead we built out a whole calculator with a model I’ve iterated over dozens of studies for calculating Market Mindshare. You just plop your survey responses into this tab, and the calculator automatically cleans, calculates, and populates all the mindshare scores for your Market Command Matrix. It also spits out a bunch of insights on your Competitor Dashboard and Competitor Profiles, but more on those later.

To finish your Market Command Matrix, you then need to answer a couple of questions highlighted in yellow in the calculator tab. I’ve put a deeper dive toggle below on how to answer them, but they’re super simple.

Deeper Dive: Three quick decisions to finish your Market Command Matrix

To finish your Market Command Matrix, you’ll need to input three pieces of information in the calculator tab you pasted your survey data into:

- Do you want to override any Market Mindshare scores?

You shouldn’t need to, because these are based on a lot of iterations of looking at competitive data and we made the command center relatively universal, but we gave you the option. - Do you want to include Site Visit data?

Site Visit data is used as a measure of the ability to find a competitor even if the customer’s unaware of them. We’ve found it’s a really good proxy, because it measures how good a competitor is at getting traffic.

Your assistant or team member will collect this data in the monitoring section, so we recommend waiting to input this data until they complete their research. More on that in the next section, but when they put those data points into the tab, the Market Mindshare scores will update. - You need to input each company’s Resource Scores

One of the axes on our Market Command Matrix is Resource Strength, which measures the amount of resources each competitor has dedicated to your space.

When testing the Competitive Command Center for different industries, we found creating a universal model fairly difficult and not dramatically consequential to the matrix overall. In the spirit of keeping the project efficient, you’re going to score each competitor on 1 to 5 scale.

Don’t worry. It’s pretty easy.

You’re scoring the resources they have dedicated to winning your specific market, not against each other (or you). Your market’s #1 company likely has a lot of resources dedicated to your market (so a score of 5), whereas Excel likely doesn’t care about your industry specifically (so a score of 1).

A hack I like to use here is to score your company first and then the rest of the companies on the list in the context of you. If you’re HubSpot, you’re a 5, even compared to Salesforce (who’s also a 5). If you’re a startup that’s 6 months in, you’re a 1.

Don’t overthink it, and don’t worry about being perfectly precise. It’s subjective, but here are a couple of good rules:

And that’s it.

With one survey and a couple of questions you now know exactly how your market thinks of you and your competitors with your very own Market Command Matrix. You also gained a ton of insights into who customers use and how they think about them.

That’s cool – but how do we actually use the matrix?

Well Neo, we’re going to get into that in the monitoring and playbook sections where we’ll go deeper on how to use the research and data to siphon and protect revenue from your competitors. Before that though, let’s walk through how to think about your market depending on how you Market Command Matrix turned out.

Interpreting Your Market Command Matrix

Without collecting any additional competitive research, your matrix can tell you a lot about your market. You just need to look at it’s shape.

Is it super fragmented with no clear market leaders? Then you may not need to do much in terms of competitive playbooks, but you’ll need to accelerate your growth considerably to become the market leader.

What if there’s one big dog and a bunch of challengers? Then you’ll need to go all out and attack the big dog.

After looking at a bunch of Market Command Matrices over the years, there are four general shapes markets take:

Intensely Fragmented Market

In a fragmented market, there’s no clear winner, even if a number of competitors exist. If your market looks like this, it’s either really good news or really bad news. It’s good news if the market’s just nascent and no one’s been crowned the winner yet or the market’s just so freaking big no one’s pulled ahead yet. It’s bad news if the market’s just not worth much, which explains why no one’s winning, because there’s not enough money to make the market worth pursuing.

Capitalism is funny this way. It’s forces are undefeated in gobbling up value where it exists. If your market looks fragmented, you can use this principle to determine if you should continue to move forward or not.

I wish I would have run this analysis the first year of building ProfitWell, because this is how our market for subscription analytics looked. The market’s small. There’s only 150k target customers and the willingness to pay for analytics (of any kind) is crap. Obviously it all worked out, but it worked out despite our market. Doing this analysis would have saved us 18 months, because we either would have made our metrics product free sooner or we would have turned out resources to another product.

If you decide that your fragmented market is simply just nascent or so big no one’s winning yet, then keep going. You likely won’t have a need for a lot of competitive playbooks until your market matures, because there’s not enough juice to squeeze out of your competitors. I would still set up the monitoring program (the next part) with your closest rivals, but use the rest of your time going as quickly as humanly possible capturing market share and growing revenue.

Challenger Market

A challenger market has 1-2 big dog competitors that got way ahead early. They typically had a first mover advantage and no one caught up to them, because they had some innovation that couldn’t be replicated or no one realized the value of the market. Eventually those barriers fall though and a ton of competitors join the market.

If your matrix looks like a challenger market (and you’re not the big dog), most of your competitive playbook energy will go to attacking the 1-2 big dogs. You’ll have a huge advantage, because you don’t have to fight multiple competitive fronts and you can even partner with like sized competitors to take on the big dog together (more on this later).

Ancient Market

Ancient markets are my favorite, because they’re sleeping giants. Historically they’re full of multi-decade old incumbents in a boring industry that twenty something entrepreneurs don’t find exciting. Typically a number of companies have high market share, but so much of their traffic is direct or doesn’t require them to make much of an effort anymore that they aren’t spending a lot of resources on the market.

If you find one of these markets, go all in. Product innovation is typically stagnant, customer experience is normally crap, and many customers are ready for a “new thing to try.” This is because the incumbents haven’t really been challenged. If you innovate and provide new value, great companies can be created in these markets. From a competitive standpoint, you’ll use most of our Harvest playbooks below.

Mature Market

Mature markets are pretty standard for a market that’s been around for a bit. You’ll have numerous solutions throughout each quadrant. Valuable mature markets will be relatively dynamics with companies entering and leaving the market quite often. Less valuable markets tend to stay static over time.

If you’re in one of these markets, you should make sure to run all the playbooks. They’ll help you siphon revenue, but more importantly they’ll protect your revenue and overall marketshare as you grow. This is because most mature markets have less inertia given their high level of competition.

Other market shapes besides these four exist, but these are the main ones you’ll encounter. All markets have their tradeoffs for growth and you should run the global sweep at least every six months to see how your market’s shifting (and if your company’s improving). The matrix is a beautiful litmus test of progress, as it’s tapping into exaclty how your customers think.

Knowing where you and your competitors stand is obviously great, but we also need to use this knowledge to gain revenue with our competitive playbooks.

Before we get to running those, we have one more part to walkthrough – extracting more intelligence for the right list of competitors. We’re going to use the same workflow intelligence analysts use to understand targets. I promise you it’s less work than what we just went through, because we automated and outsourced most of the heavy lifting.

Part 2: Monitoring and Extracting Intel

The United States spends roughly $85B on the intelligence community every year (eg. CIA, NSA, DIA, et al). That’s about 1% of the government’s budget, and it’s not spent on what you think. Most of the budget isn’t for supporting the military or conducting James Bond-ian missions. It actually goes to monitoring and gathering intelligence on our allies and enemies.

You may think that’s a waste of resources, but think about this for a moment: what’s that budget bought over the years?

The US is the envy of the world and our planet’s one and only superpower. Your values may spark some puckering anxiety when reading that, but the numbers don’t lie. I personally have seen conflicts get stopped before they start or negotiations won – all because of intelligence. In any interaction with any institution or human in the world, we always have the upper hand, because we already possess or have the ability to quickly gain enough judgment on the parties involved.

That judgement then allows the US to act quickly and effectively.

You already know the importance of building your judgment. We do that through intelligence, which provides breadcrumbs of research and data about your primary target – your competitor’s customers. Those breadcrumbs tell us everything.

Revenue and growth trend breadcrumbs let us reverse engineer which competitor campaigns are working.

Customer product sentiment breadcrumbs tell us which competitor features are vulnerable for us to attack.

Job posting breadcrumbs tell us exactly what a competitor’s strategically prioritizing.

We study these breadcrumbs to find patterns. Those patterns develop instincts around how our customers and competitors think. These instincts then then inform the actions we take to convert those customers to our product.

Put more simply – gathering intelligence on your competitors gives you superpowers. With just one hour per month (or quarter), you’ll understand your market better than anyone. You’ll see exactly which competitors are growing and which are slowing. You’ll know the pulse of how customers view your market, so you’ll know exactly which messages move them from your competitor to you. As the layers of data build up over time, you’ll even see patterns emerge that your competitors could only dream of seeing.

You won’t be an oracle, but you’ll sure feel like one.

Most importantly though – you’ll make infinitely better decisions, especially when running competitive playbooks. Plus, it’ll be intensely fun, because you’ll focus on what’s most important – strategy.

Does that fire you up?

Good, but it seems like it’ll take a lot of work, right?

Wrong.

You won’t have to spend 1% of your budget. There are two components of your monitoring program: data collection and analysis. Data collection’s collecting the breadcrumbs. Analysis is reading and skimming the data for themes and trends.

You’re a business leader, so you don’t do the first part. Your time shouldn’t be spent sourcing and cleaning research. All your time should be spent on the second part. Knowing the market and making decisions based on that knowledge is how you earn your paycheck.

To make this happen we built an “ NSA in a box” for your company. Inside the box we take the competitors you need to monitor (those in the All Out Attack, Harvest, and Just Monitor sections of your Master Command Matrix), and put them in a system where your assistant or team member collects all the intelligence and research in 2-8 hours per month (or quarter). They’ll have all the instructions and tools they need.

That’s it. It’s that simple.

They use the tools we built to do the bulk of the work. You spend that one hour per month (or quarter) and then use the findings to implement the right playbooks to attack your competitors or defend from their attacks.

Let’s go deeper though, so you understand exactly how you’ll spend that hour, what research and data you’ll look at (and where), and what your assistant or team member’s process will look like each month (or quarter).

Your Intelligence Monitoring Workflow

To build judgment you need to track a target over time along axes that matter. For a terrorist you want to understand their routine and movements, close and continual contacts, and how they act and respond to other actions. For a competitor you want to understand how they see and position themselves in the market, if they’re growing and how, and how they respond to adversity. It’s as much about learning as it is about taking action against them.

Knowing these axes as a single point isn’t helpful. You need to string together many moments and data points over months or years. You then make predictions about what you think they’re going to do and check how often you’re right. As you hunt them, your profile gets better and better. That profile’s where you gain your leverage, because your increasingly better judgement allows you to use our attack or defense playbooks infinitely better.

All of that’s great, but what are you actually doing in that hour per month (or quarter)?

Most of your work takes place in your Judgment Log, a central document where you catalog your reactions as you review the research collected for you. Every month you’ll review the research that’s been collected for you and note any notable changes or themes for each competitor. You’ll then log those observations in your judgement log.

For each competitor’s research, you’ll answer:

- Did anything I predict last time turn out to be right? Wrong?

- What do they seem to be focused on? Has that changed?

- What do I think they’ll focus on or do next?

- Where do they seem strong? Weak?

- Did I have any notable conversations with people connected to them? What’d you learn from them?

When you do this oncer per month for six months (6 hours) or oncer per quarter for four quarters (4 hours), I guarantee you will understand your market better than anyone and make infinitely better decisions.

You will amaze your team.

You will amaze your investors.

You will amaze yourself.

Where does the research you’ll review live?

Your team or assistant is going to collect a ton of data and research for you using the tools and instructions we built out for them. To make your (and their) life easier though, we’ve curating all of the research into three places. You only need to read and skim these three assets, which is how we’re able to achieve you getting all the value out of a monitoring program in only and hour per month (or quarter).

We’ll go deeper into data that goes into these assets, but let’s walk through what they are and their purpose:

Your Market Intelligence Stakeholder Deck

This deck contains a high level summary of the research and data on your core competitors. You’ll see overall growth trends, customer product sentiment summaries, and how your competitors compare to one another on multiple axes.

The deck purpose’s is to give you (and your team) a pulse check on how the market’s shifting over time (if at all). You won’t find all the nitty, gritty details, because those can get distracting to your team.

When doing my monthly (or quarterly) review I look through the deck and note any themes or changes that seem to be happening. Are any competitors on an upswing or downswing (eg. someone just raised a massive funding round)? Has there been a big shift in customer sentiment (eg. a competitors review ranking dropped)? Is the market going up or down? Are there any new entrants?

After noting my thoughts in my Judgement Log, I then send a note to my board and executive team using the following copy:

Note to stakeholders on how the market’s shifted

Hey everyone – we’ve refreshed the Market Intelligence Deck. I’ve linked it here, but a couple of observations:

Things that have changed

- INSERT ANYTHING THAT’S NOTABLE AND CHANGED

Things that seem to be holding steady

- INSERT ANYTHING THAT’S NOTABLE AND CHANGED

Action items from this data

- INSERT ANY ACTION ITEMS

Your Competitor Dashboard and Profiles

After looking through the market intelligence deck, I review the Competitor Dashboard and Competitor Profile for each competitor.

These house all the nitty, gritty details about each competitor and the market as a whole. You’ll find data ranging from headcount, lifetime value, and NPS to tech stack, customer lists, and feature value output. In short – every detail that’s important to building judgment on your competitor exists in these profiles and dashboard.

You’ll use this data more in-depth for the playbooks, but when I’m reviewing it for my Judgement Log I’m looking for notable changes – did they land a new big customer? How’s NPS shifted? Things like that. I’m also looking at how competitors stack up to one another since all the data lives in the same place. I can easily see each competitor in the context of others – eg. two competitors seem to gaining the same amount of ground, because of a new feature that’s popped up in the review sentiments.

We’ll go more deeply into the specifics of this data in the next subsection.

Your Media Monitoring Labels

After looking at all the growth and trend data, we’ll review the key messages your competitors and their key employees are sending via Media Monitoring.

Here your assistant or team member set up an inbox label system to track every important message sent from and about your competitor. Marketing messages, podcast interviews, investor updates, CEO subtweets – everything’s ported to one place.

You’ll monitor these messages, because they’re the key to unlocking what your competitors are pushing onto the market. You can also see if those messages are resonating or not when comparing it to the growth trends in the Competitor Dashboard. For instance, a competitor may switch their marketing messaging to be about a particular feature, but after a few months that feature doesn’t show up in any customer reviews. This probably means the feature’s a dud and the competitor’s team either didn’t do their research or missed something.

You’ll note these observations in your Judgement Log and over time you’ll start to realize all things about your competitors – which have product teams misaligned with their marketing teams, which are really good at knowing what customers want, and even which seem to have the most disgruntled employees.

To recap – every month (or quarter) for an hour you’ll look through a deck, a dashboard, a profile for each competitor, and a few email inbox labels. You’ll then record your thoughts in a document. That’s it.

To make it this even easier, the the setup instructions your assistant or team member will run through will also trigger recurring calendar invites for you, so you don’t have to worry about remembering to review your research.

Try not to skip a cycle. It seems like you’re just learning and not doing. Yet, the hour you spend reviewing the research and filling out your Judgment Log is the highest leverage hour you’ll spend. You’re not just learning about your competitors. You’re learning about your customers and market. You’ll see what’s working (and not working), as well as how your market shifts. I can’t think of a better way for an operator to spend their time.

Of course, you’ll also use all this research and judgment to run your competitive playbooks. We’ll get to those, but let’s first walk through specifically what you’ll find in the research before explaining how your assistant or team member will collect everything automatically.

What intelligence will your team collect?

When monitoring and hunting targets you learn that every target has a goal, and the key to exploiting that target for your own means is understanding that goal. When you do the goal reveals why they’re doing what they’re doing, as well as helps you predict what they may do next. It also let’s you see if those efforts are working or not.

Knowing a target’s goal is tricky though. Goals have many layers and sometimes the target doesn’t even understand them. A terrorist may think their acting out of religious dedication, but in reality everything they do actually stems from the want of status within a community.

Analyzing the goal of a group’s even trickier. A government or group’s made up of many sub-groups that are all made up of many people. Every stratum may have different, and sometimes contradictory, goals that all aggregate into a particular direction.

Thankfully businesses aren’t that complicated.

Every businesses goal is to make money. Sure, the underlying goal of the people who work there may be different – building a good life, world domination, making the world a better place, etc. Yet, the core goal is still revenue.

The revenue goal makes collecting intelligence on our competitors supremely focused – we want to collect research and data that reveals what they’re attempting to do to drive revenue and then if it’s working. Think of these as inputs and outputs. For instance, a competitor may push a new marketing campaign that talks up their amazing support (an input). We can then see if any of their reviews or customer sentiments mention the support (an output). If not, we can determine the input didn’t do much and the input likely didn’t move the needle.

We’ve put together a comprehensive research program that tracks the right inputs and outputs for each competitor and puts them in your dashboard and profiles. All the work’s done for you. Your job’s (as we talked about already) is to skim and read the research for your Judgment Log and then use the data in our playbooks for attacking and defending.

You should still understand the specific data and research we’re collecting though. It comes in three categories. Let’s walk through each.

Outputs: Competitor Growth and Sentiment Trends

We don’t inherently care about our competitor’s companies specifically. We care about how customers and potential customers view these companies. Do they like the product? Which type of customers like the product most? Why? How’s that changing over time? Are they continuing to buy? Have they stopped?

In a sense you’re a detective trying to understand which aspects of these products resonate or don’t resonate with customers. Knowing these trends exposes where a competitor may be vulnerable or strong. We can then choose to steal or reject these aspects for our own products. We can also exploit these vulnerabilities with our playbooks.

To get these insights, your assistant or team member will track data like headcount, revenue, and site visits on a monthly (or quarterly) basis. They’ll also run sentiment analyses on customer and product reviews. We even gave them a script to pull competitor customer logos from multiple sources. All the instructions have been built out for you. You’ll just see the results in your Competitor Command Center. For a full list of data and research though, check out the deeper dive toggle below:

Deeper Dive: Which growth and sentiment trends will be collected each month (or quarter)?

Here are the trends your assistant or team member will pull for you on a monthly (or quarterly) basis:

- Core data

While we don’t care about a competitor company in and of itself, where they’re located, how much funding they have, who their investors are, and the like are all crucial to painting an image of their risk appetite and effort level. For instance, a San Francisco based competitor with $500M in funding who gains all their sales through paid media acts differently than a Boston based competitor with $100M in funding who gains all their sales through events and community. I’d fear attacking the latter more, because they had to gain more leverage with their funding than the former. Their customers are likely harder to steal, too. - Key People

Anyone you have or want to have a relationship with at the competitor company should be consciously listed out and tracked. These folks you’ll gain intelligence from directly and indirectly through conversations and tracking their public communications (interviews, Twitter, etc.). They’ll also be the folks you’ll want to build relationships with when it comes to M&A and partnerships (both of which are crucial in a competitive ecosystem). We’ll talk more about these relationships later. - Growth data

Knowing competitor growth is paramount. Headcount and site-visits are good proxies, but there are some obvious and non-obvious ways to also gather revenue and customer counts. Growth trends give you a picture of how the market’s being shaped (and your position in that journey). It tells you who’s vulnerable. It tells you who could kill you. It also allows you to know how and when to respond to different competitor actions. For instance, I’ve had success taking multiple like sized competitors and using the frustration they all have for the top dog in the market for joint marketing campaigns. - Customer and Product Sentiment

To siphon customers from competitors (and ensure you keep yours), you need to understand how customers perceive a competitor’s product. Sentiment data’s crucial to running any competitor sales and marketing campaigns. For instance, in building ProfitWell Metrics, we discovered quickly customers complained about accuracy amongst our competitors. We fixed our own accuracy and then made most of our competitive marketing about said accuracy. It was the highest ROI campaign we ever ran. - Customer Lists

A number of our playbooks target competitor customers specifically. To do that, you need to start building out a list. Some competitors customer lists are easy to find – using tools like Clearbit, BuiltWith, etc. Yet, all competitors expose a portion of their customers on their website via logos, testimonials, and case studies. Each month (or quarter) your assistant or team member will pull these logos and maintain a list of customers using your competitors. - Other Trends

Depending on your market, customer, or product there may be other relevant trends to track. I’ll go through this more in a bit, but if you fill out the “Settings and Instructions” tab, you’ll be prompted to add these trends to the list. They’ll be automatically added to the instructions for your assistant or team member.

Inputs: Competitor Media Monitoring

Trend and sentiment data is one half of the judgment puzzle. It shows you what actions worked (or didn’t) for a competitor in your market. The other half is going upstream of those results.

We need to understand what your competitors are pushing into the market. How are they trying to shape the world your customer sees? This is where monitoring your competitors media flow comes into play.

To do that we’re going to push every major and minor message your competitors’ stakeholders put out into the world into one place. Obviously their sales and marketing messages will tell us which themes they’re trying to push on the market. Yet, companies are oblivious to how much other rich intelligence they consciously spew (especially via their employees). Their job postings will tell us what they’re prioritizing. Their glassdoor reviews will tell us when they’ve shifted strategies. Even their key employees’ social media profiles will tell us how things are going.

We’re going to monitor everything each competitor is pushing on the market. We’ll then combine these findings with our growth and sentiment trends above to paint a complete picture of what your competitors are trying and if it’s working.

Functionally media monitoring sits in an inbox with each competitor’s messages and alerts going to an email label. During your Judgement Log hour you’ll simply click each label and review the messages that’ve come through, noting any themes or trends in your log. We’ll also use these findings in our playbooks.

Your assistant or team member will set your media monitoring up for you, but if you want a deeper dive of all the messages they’ll track for each competitor, check out the deeper dive toggle below.

Deeper Dive: Which messages will we track for each competitor?

Here are all the media sources we’re going to track for each competitor (and why they’re critical):

- Marketing, sales, and customer email lists

How your competitor communicates to the different parts of the funnel shows you exactly what they find important. Which features do they highlight? What value propositions? Do they seem to hammer any channels indicating that’s working for them?

My favorite is when what they think is important has nothing to do with what their customers find important (something you’ll find when doing your global sweep in Part 1 above), because that’s a mismatch we can exploit all day, every day. - Social media feeds

Companies never pay social media marketers enough (nor hire enough of them), so they slip up all the time and are a goldmine of high signal data.

We’re going to watch for posts that either reveal a bit too much (eg. talking about the goals of the company) and posts that are way too coordinated. The latter indicates that whatever they’re talking about is a high priority internally. For instance, if all of a sudden every post is about startups, indie hacking, and small businesses, it indicates they’re going down market. - Key employee social media feeds

If not for the revenue that comes from social media (and this small thing called free speech) I would not allow team members to use social media (myself included). They reveal so much. Junior employees say too much. Executives try to subtweet their ambitions. Disgruntled employees piss and moan passive aggressively. It’s amazing signal to build judgment. Even if none of that happens I can tell an amazing amount by when a consistent tweeter all of a sudden stops – 9 out of 10 times the company’s going through a bunch of pain. - Board member social media and email feeds

Most companies listen to their boards way too much, but their boards don’t listen to them. It’s not their faults. They have 10+ companies, so they speak in themes, telling each things like, “you need a PLG strategy” at the same time.

We can take advantage of this by understanding what their board members are sharing to social media and their email lists (if they have one). You know that message is going to the company, and at least half of companies will scramble to adjust and listen. It’s the wrong move, but it happens and you should watch out for it. This also works well for M&A. I used what one of our competitor’s board members were talking about to leverage into an acquisition conversation, because we would “fulfill that thing NAME keeps talking about.” - Google Alerts and Paid Media

Depending on your industry, knowing who’s talking about your competitor can be incredibly valuable, especially when seeing how they’re describing them. If they always seem to get bad press, I want to capitalize on that. Good press? I want to ride whatever wave they’re riding. Google Alerts let you somewhat efficiently set monitoring up across the web.

For some of you (consumer or e-commerce brands), you’ll also want to set up paid media monitoring. The way a company uses advertising is a huge signal, because it shows what’s working for them (aka what I’m going to steal). For both web monitoring and paid media monitoring there are great tools, but I’ve found the basics work pretty well unless you have a very specific need. - Job postings

Team members are “resources” at a company. When a company has a change in strategic plan, what do you think they do first, especially after annual planning? They align the job postings they need to the strategic plan, and you bet your bum I’m going to exploit the heck out of that.

I’m going to look for shifts in the descriptions over time, how many engineers they’re hiring, and the titles of any directors, VPs, or C-levels. With these I can ascertain how fast they’re moving and in which direction. We’ve built an AI prompt for analyzing priorities of job descriptions in the VA instructions below for you - Glassdoor reviews

Glassdoor is not a great signal of the quality of the company, but it’s an amazing treasure trove of what’s being talked about or struggled with internally. Angry employees do not care about NDAs or saying too much, and they say too much all the time.

I’m going to look for a lot of key words in these reviews. Things like “the strategy changes all the time and no one knows what’s going on” means management sucks. “The culture used to be fun” means they wait too long to fire people and likely had a layoff. Any complaints about snacks or fringe benefits means the mission is weakly communicated and they’re not moving quickly enough. We’ve built an AI prompt for analyzing these in the VA instructions.

Bonus: How to Turn and Use Human Assets

The core of your monitoring program is on data and research we can source from outside an organization. It’s all that’s truly necessary. Yet, if you want more specific insights or context, my favorite source are humans involved inside a competitor.

Employees (both former and current), investors, and partners give up the most prized information. This is because they’re humans, so they can tell you more in one conversation than you can learn from a dozen marketing emails or a growth trend.

As a side note, building these relationships is also just good practice. While building my company I went out of my way to meet and build relationships with our competitors. Some of these relationships never went anywhere. Others lead to co-marketing and partnerships. One in particular lead to our acquisition. You won’t know which ones will produce revenue, so I find a general willingness to be open to conversation a best practice.

To do that you don’t need a team of super spies either. You’re already monitoring their social media communications through your media monitoring. Now you just need to layer on 1:1 conversations with key stakeholders. You’re probably already doing some of these through general networking.

The shift from what you’re already doing comes in who you approach for conversations, how you approach them, and what you do after them. You’ll seek out specific people and look for specific insights throughout your conversations. You’ll then record their thoughts in your Judgement Log after you have them. Every conversation will lead to rich insights that’ll build your judgment in ways you just can’t get from anywhere else.

Since there’s so much value in developing human assets, let’s go a bit deeper here. Remember, this isn’t completely necessary, but if you’re a couple quarters into your Competitive Intelligence Program and want to start layering on advanced tactics, this is where I’d start.

To get a breakdown of my approach to identifying assets and having conversations that lead to interesting findings in the toggle below.

Deeper Dive: Identifying assets and tactics for conversations that lead to insights

My approach has two key parts:

- Identify important assets

Your assistant or team member will build out a list of the obvious key people for each competitor (leadership team, board, etc) when they run their research each month.

That being said, I like to look for people who actively or passively fill the following categories:- Employees as they’re leaving